For many years, mortgage brokers possess used ordered head listings to help you ferry for the mortgage cash. Unfortunately, ordered guides are expensive, and their lofty cost does not ensure they will certainly convert so you can finalized loans. Lenders is also spend a lot of cash merely to get an effective a number of tire kickers who aren’t in fact primed to shop for a home.

A shorter discussed downside out of purchased prospects is because they is do a poor reliance on third parties to pass through sales funnels. A habits for the purchased leads not simply weakens a lender’s brand name, but inaddition it implies that an organisation was missing out on possibilities to just take the organization of connectivity currently in database.

Additionally, the current lead generation steps dont render causes loan providers very early adequate regarding the conversion harness. Entertaining that have possible consumers during the start of the home to get trip is far more crucial than simply of many lenders recognize. Indeed https://paydayloancolorado.net/swink, an individual Monetary Cover Agency (CFPB) has actually found that more 30% off consumers dont shop around getting home financing after all, and most 75% regarding consumers implement with just that bank.

A broken program to have loan providers and you will people

Technologies having welcome consumers to search assets listings off anywhere into one product do-little to assist individuals know the real real estate electricity. Homeowners know that making it possible for creditors to pull an arduous borrowing from the bank declaration can be negatively connect with their credit rating. This will make consumers less likely to want to build relationships a loan provider up until he or she is sure that they are ready to initiate the brand new financial procedure.

The contrary options are not much most readily useful, sometimes. Websites that allow people so you can complete a form to evaluate their credit or guess purchasing energy commonly usually promote consumers’ private research. Entering a message or phone number towards a web site function simply once can cause unlimited conversion calls, characters and you may sms.

Starting the latest HomeScout Licensed Borrower

Inside a mortgage land rife which have race for sale company, loan providers need high quality prospects that demonstrate both intent to shop for a good family and also the power to see financial resource. However with the borrowed funds Bankers Organization (MBA) reporting average design can cost you from almost $10,700 for each and every financing in Q1 2022, loan providers are trying to chances to cut back sales and you may operational will cost you without having to sacrifice the amount or quality of their purchase candidates.

FormFree and you can HomeScout has actually partnered to deal with the need for prospects you to definitely submit an unquestionable profits on return that have HomeScout Licensed Borrowers (HomeScout QBs), mortgage-in a position customers qualified in front of the house to buy travel.

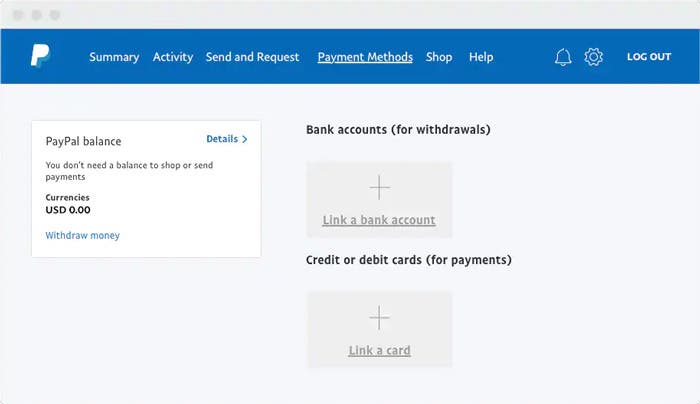

HomeScout means potential housebuyers in the great outdoors and in this a lender’s database into the basic level of domestic to invest in – in the event it things most. This type of users need higher understanding of their home loan qualification at start of property travel without having to be punished having credit concerns, deluged with advertisements or hounded by mortgage originators to do an enthusiastic application. So, HomeScout and you may FormFree promote homebuyers the ability to understand their residence buying strength because of the electronically verifying the direct-source economic study right from their computers or smart phone.

That have domestic shoppers’ permission, FormFree utilizes its contacts having loan providers and its patent-pending Continual income Education Index (RIKI) to help you supplement traditional borrowing analysis with analysis off property, cashflow and you can residual income, bringing a complete picture of the fresh customer’s Capability to Shell out (ATP) and you will potentially allowing so much more homeowners so you can qualify for a home loan. What’s more, HomeScout together with considers the brand new average house rates inside the a given household lookup urban area when quoting a great QB’s power to pay money for a good financial, providing loan providers and you will QBs a practical image of just how much house they could it really is pay for.

HomeScout Qualified Individuals bring lenders ideal-notch worthy of as the, in lieu of lookie-loos that merely window shopping, QBs have higher intent to order. This is certainly a significantly-required creativity, because the destroyed day invested with very early-stage homebuyers who are not it really is mortgage-able has actually a far greater pull on the mortgage originators’ returns and the user experience than of numerous lenders care to distinguish. QBs offer the higher inclination to close the mortgage industry provides ever before viewed given that loan providers is also build relationships this type of borrowers throughout the suggestion away from spear – when they’re very first looking household in place of when they decide to sign up for a loan.

FormFree and you can HomeScout have created a seamless procedure getting lenders in order to be certain that a QB’s ATP using head-resource bank data sent thru a secure QB token. QBs allow loan providers to analyze a consumer’s possessions, throw away and you can discretionary money, employment and credit score when you look at the near actual-go out. When an effective homebuyer opts into the QB system inside house research stage, it approve a credit delicate eliminate. Such credit query does not connect with its credit score, but it provides an additional information section included in the head.

By putting the consumer in control of their data and you may homeownership experience, the QB program will also help handle homebuyer trepidation throughout the typing its information that is personal on the internet and against a keen onsl. A great QB has got the chance to know the ATP before getting hooked toward a relationship having a specific lender otherwise real estate agent.

In the course of a moving, high-rates buy environment, FormFree and you can HomeScout are creating a fast services that give far more wealth-building possibilities to possess users and you can lenders the exact same. The brand new companies’ financing during the invention was repaying giving loan providers a much better, a whole lot more comprehensive solution to fill the pipelines with early-stage, mortgage-in a position pick leads.